Understanding the concepts and components of purchase price is the first step to better deal making. Multiple studies have shown that price to book value PB is the most effective valuation measure in determining a stocks performance.

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books

Therefore book value is roughly equal to the amount stockholders would receiv.

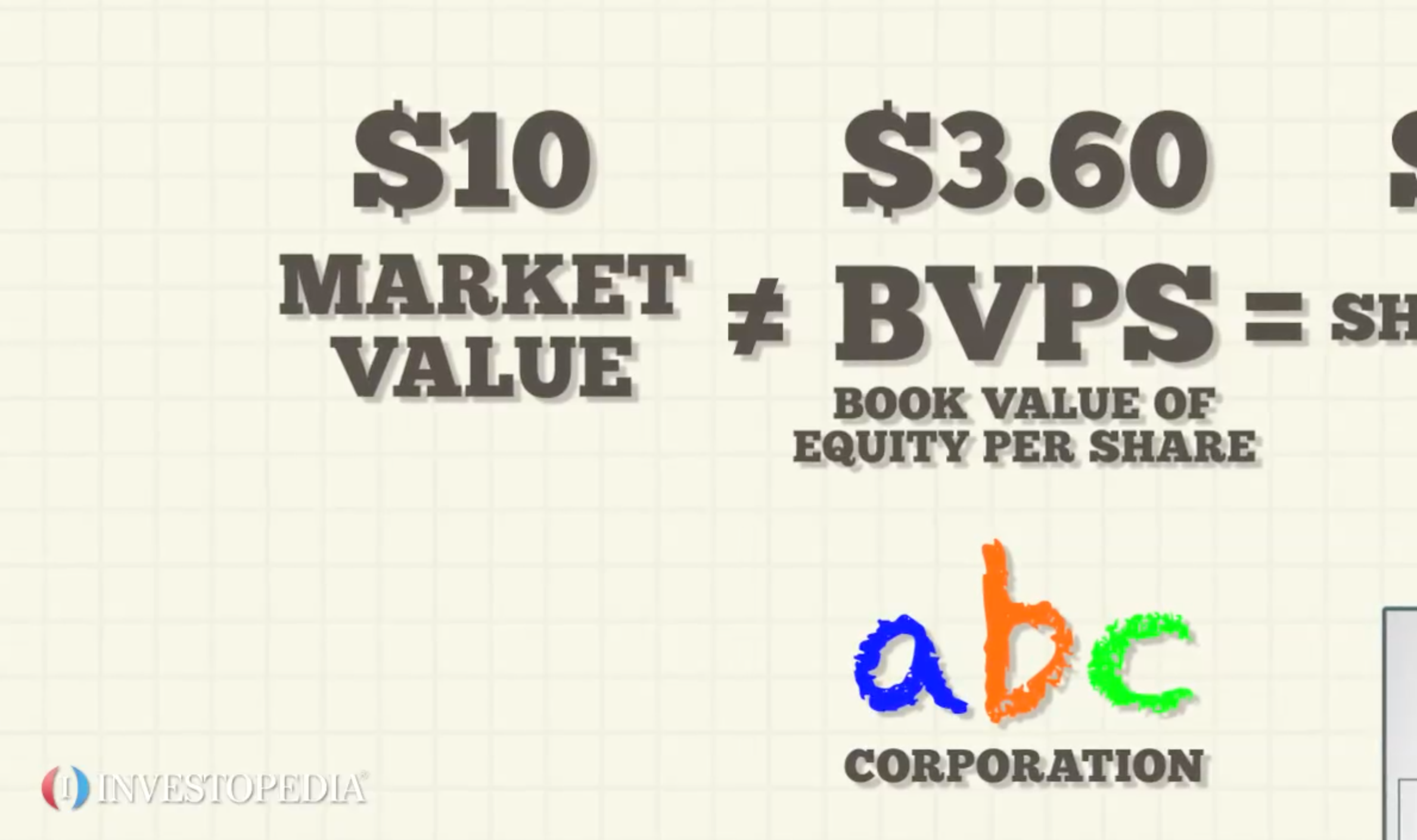

. The book value of stock is based upon the companys books. Book Value is the actual worth of an asset of the company whereas Market Value is just a projected value of the firms or assets worth in the market. This liquidation value can be lower than the book value especially when the firm is sold off on short notice when there are fewer bidders.

Some buyers will use only multiples of 45 to 5 times EBIT. Price is what the company charges for goods or services from its customers. Its current price is 3500 should the investor purchase this stock.

For any given bid or transaction the difference between purchase price and book equity measures the premium a buyer is willing to pay over and above the book value of a companys net operating assets. Book value also known as adjusted cost base ACB is calculated by adding the total amount of contributions made by an investor into a mutual fund plus reinvested fund distributions minus any withdrawals. Another reason that trade-in values are lower than retail prices is that most trade-ins need reconditioning.

If Company B purchases Company A for 250000 the amount of economic goodwill created would be the purchase price minus the fair market value of net assets. Theoretically it is what investors would get if they sold all the companys assets and paid all its debts and obligations. Cost is the what the company pays to acquires goods and services for production whereas and Value is what goods or services pay to the customers ie.

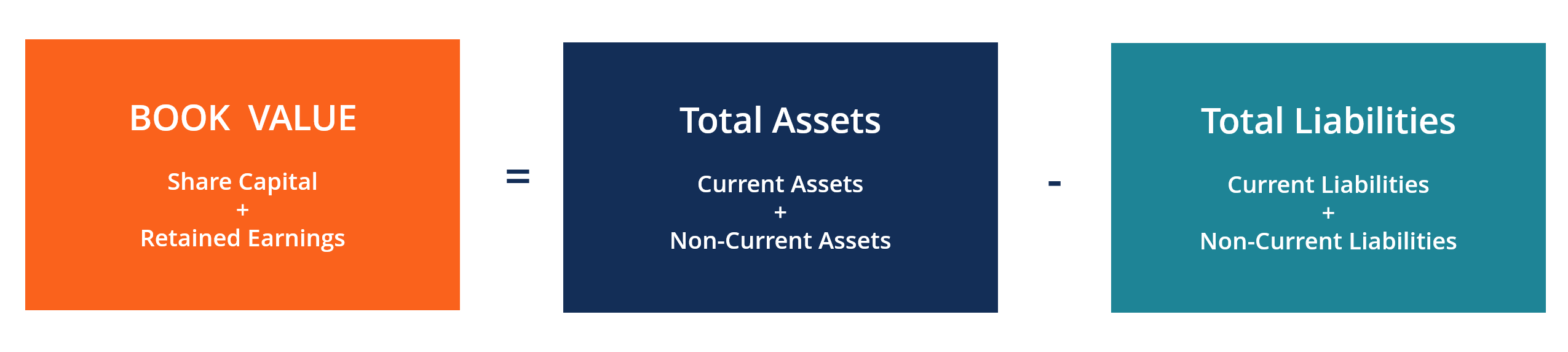

The book value literally means the value of a business according to its books or accounts as reflected on its financial statements. The difference between the companys assets and liabilities is its book value. Book Value of Securities.

Book value also known as carrying value or net asset value is an assets value as recorded on a companys balance sheet. Although the price-earnings ratio PE is considerably more popular buying at low price-to-book multiples leads to better returns. For example you purchase a car.

Some buyers will raise or lower their EBITDA multiple for valuation purposes based on the relationship to the proposed selling price. Book value serves as a reference point. In essence book value is determined as the original cost paid for the assets acquisition adjusted for any depreciation amortization or impairment attributable to the asset.

Book value is the amount you paid for an asset minus depreciation or an assets reduced value due to time. Answered step-by-step 1Explain why the market value of common stock often differs from its liquidation value or its book value. Then as time goes on the cost stays the same but the accumulated depreciation increases so the book value decreases.

Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. It doesnt matter whether that news is good or bad. The number of buyers or sellers for a given stock on any day depends on many factors such as market trends and the current news.

250000 209000 41000. Instead they devote time and money to get the vehicle ready for its next owner. The book value of assets is important for tax purposes because it quantifies the depreciation of those assets.

For example consider a person selling gold bars for 5 a piece. The enterprise value EV is an alternative valuation metric that reflects the market value of an entire company in a way simple market capitalization figures cant. The value of assets or securities as indicated by the books of the firm is known as Book Value.

Market value is that current value of the firm or any asset in the market on which it can be sold. Book value is the theoretical value of what a companys net assets are worth. The major difference between market value and market price is that the market value in the eyes of the seller might be much more than what a buyer will pay for the property or its true market.

After the initial purchase of an asset there is no accumulated depreciation yet so the book value is the cost. The concept can also be applied to an investment in a security where the book value is the purchase price of the security less any expenditures for trading costs and service. Fair value PPE is higher than book value due to depreciation being greater than the decline in PPE fair value.

It can mean that the stocks price will rise when there are more buyers than sellers while more sellers than buyers can mean that the price is about to fall. A stock offers an expected dividend this year of 350 has a required return of 14 and has historically exhibited a growth rate of 6. Also known as net book value or carrying value book value is used on your businesss balance sheet under the equity section.

The most important distinction between price and value is the fact that price is arbitrary and value is fundamental. Comparing Book Value and Market Value There is nearly always a disparity between book value and market value since the first is a recorded historical cost and the second is based on the perceived supply and demand for an asset which can vary constantly. The book value of a company is the net difference between that companys total assets and total liabilities where book value reflects the total value of a companys assets that shareholders of.

If book value is higher than half the selling price some buyers will use a five to six multiple. The write-up amount is determined when an independent business valuation specialist completes the assessment of the fair market value of assets of a target company. At the end of the year the car loses value due to depreciation.

The journal entry for the purchasing. In theory this is the amount that the shareholders would receive if the company were to be completely liquidated. A dealer typically wont sell a car immediately after receiving it in a trade from a customer.

That figure divided by the number of shares will provide. A write-up is an adjusting increase to the book value of an asset that is made if the assets carrying value is less than its fair market value. For example if a company has 232 billion in.

Book Value Definition Importance And The Issue Of Intangibles

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

0 Comments